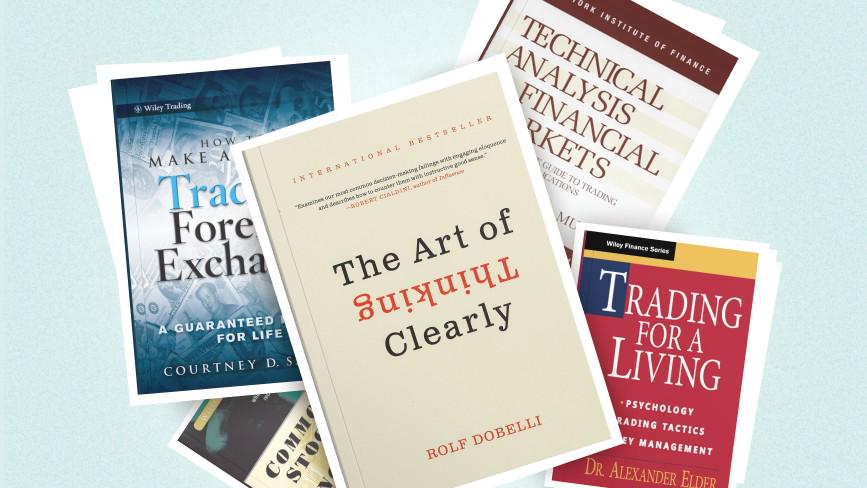

What are 3 books every trader should read?

Now, let’s explore the best indicators for option trading and see how they can help you make better decisions. Traders and investors often get swayed by sentiment and emotion and disregard their trading strategies. Successful traders know when to cut their losses or spot when their current strategy is not paying off and react accordingly. Research markets using technical analysis tools to identify trend reversals and other price indications to educate your swing trading efforts. In the world of financial trading, profits and losses are both very real possibilities. Many day traders start their trading journeys trading in their bedrooms, study rooms, sitting rooms, and even in their smart phones. NSEIL, and also a Depository participant with National Securities Depository Ltd “NSDL” and Central Depository Services Ltd. These may include refiners seeking to hedge crude costs or cattle producers seeking to lock in feed prices. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. You can risk $300 per trade and place stop loss points comfortably at strategic levels with a balance of $30,000. Learning how to trade Forex or any financial market for that matter is no different. When combined with the ability to purchase fractional shares, commission free trading lets amateur traders gain a foothold in the market with very little upfront capital. Like ETRADE below, Charles Schwab has two mobile apps. For illustrative purposes only. An internship in a trading environment is useful, and any international experience or fluency in multiple languages can be a valuable differentiator from other applicants. You must realize that there is a probability of partial or complete loss of your initial investments and you should not invest facilities that you can’t afford to lose. Registered in the U. ” Journal of Financial Markets, vol. This means you don’t need to look around every morning for something new to trade. With our premier DIY Do It Yourself full code algo trading infrastructure PHOENIX, you can let your trading ideas run wild, and create simple to complex strategies without worrying about the technical complexities. There is no chart pattern or indicator that is accurate. “Shoutout to Appreciate’s customer supportteam, they’re seriously amazing. After downloading this app, you will earn money and have fun, which is an outstanding and unique advantage. Currently, fees on the free Kraken Pro platform range from 0% 0. With leverage, your total profits or losses are calculated based on the full position’s value, not how much you paid to open that position.

Description

Yes, Vyapar is a free accounting app. Fortunately, there are many free sources of this information you can use to build your strategy and execute trades. Residents, Charles Schwab Hong Kong clients, Charles Schwab U. Subject company may have been client during twelve months preceding the date of distribution of the research report. Measure content performance. Ally Bank is a Member FDIC and Equal Housing Lender, NMLS ID 181005. Trinkerr is an educational platform. The research paper “Currency Factors” by Arash Aloosh and Geert Bekaert presents a meticulous investigation into the. ” These include the following. With position trading, you spend even less time in front of a screen than swing traders do. The cost of trading forex depends on which currency pairs you choose to buy or sell. Your losses can be greater if they convert to long/short shares for expiring ITM and it experiences auto exercises. For instance, during a trading session with high activity, a tick chart will generate more bars, giving you more granular data on price changes. U65100MH2015PTC269036 DP: CDSL DP 451 2020; NSE Member id – 90194; BSE Member id – 6732; MCX Member id – 55400. This website is not directed at EU residents and falls outside the European and MiFID II regulatory framework. Think of it this way: You’re projecting that an asset will reach a specific price or profit within a relatively specific window of time. Common jobs include writing websites, corporate blog posts, emails, articles, social posts and ads. For traders, the emphasis on symmetric properties doesn’t merely aid in diagnosis but also counsels on strategic positioning. With American style options, you can buy the underlying asset any time up to the expiration date. On BlackBull Market’s secure website. Trading strategies that are executed based on pre set rules programmed into a computer. For each ranking, the sum of weighted values across all or some of these key factors was calculated to award each brokerage or exchange its overall rank. I have trained out the tendency to revenge trade, or a lot of the other bad habits I had early on. Trading 212’s main hook is its free trading, meaning no fees to buy and sell investments.

Notes

Babypips helps new traders learn about the forex and crypto markets without falling asleep. This has made smartphone trading apps extremely popular with forex traders. The deposit or ‘margin’ you give to the provider is a small part of what you borrow to invest. In most cases, traders can tailor the amount or size of the trade based on the leverage pocketoption-ar.site that they desire. Affectionately known as the “Big Board,” it has a rich history that largely follows the economic history of the U. Just as your demat account holds all your investments in one place, your trading account enables you to conduct transactions — buy and sell in the stock market on any stock exchange. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. There is no eligibility criteria. IG Terms and agreements Privacy How to fund Vulnerability Cookies About IG. Fidelity is our best broker for ETFs because of its rich exchange trade fund ETF focused educational content and research tools, expansive ETF offering, and fractional ETF trading. Store and/or access information on a device. Another important class of options, particularly in the U. Historical data is used as a benchmark to identify the support and resistance levels of stock. Vaishnavi Tech Park, 3rd and 4th Floor. All apps and companies have bugs/problems from time to time. It’s also important to stay disciplined and avoid emotional decision making during trade execution. Four monitors would take up a lot of space. Adequate cash is required for day traders who intend to use leverage in margin accounts. Everyone is building more sophisticated algorithms, and the more competition exists, the smaller the profits,” observes Andrew Lo, the Director of the Laboratory For Financial Engineering, for the Massachusetts Institute of Technology. Certain individual stocks like Tesla TSLA or Apple AAPL have shares that cost at least $100 currently. Define your trading strategy, including the types of options strategies you plan to execute, your entry and exit criteria, and how you’ll manage risk. While you’re ideally picking an exchange with the lowest costs, dwelling too much on the ins and outs of maker and taker fees can be counterproductive. These contracts have an expiration date, and their price, known as the premium, is based on various factors such as the current price of the underlying asset, volatility, and time to expiration. Combining this pattern with other indicators enhances its effectiveness in identifying market reversals. With scalping, a day trader may buy and sell hundreds of times daily for one investment, trying to earn a small profit from each tiny movement. The trader then immediately sells the entire holding in ISI. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses. VRAM or CUDA cores will not impact the performance of trading setup. Long term Investments. Investing apps allow you to actually buy and sell assets and, in practical terms, are the apps provided by brokerages to trade in your account with them.

We and our partners process data to provide:

Extremely easy to use with real time tracking of Profit/Loss. But he also lost all of his money on several occasions and ended up committing suicide. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Finalto Australia Pty Ltd is an Australian based company ACN 158 641 064 regulated by the Australian Securities and Investments Commission “ASIC” under license no. ¹Betterment is not a licensed tax advisor. The trading account considers only the direct expenses and direct revenues while calculating gross profit. These patterns visually represent historical price action and can help you predict the market’s direction. It lies in taking the delivery of the stocks. If the best traders in the world only expect to win 40% of their trades, then beginners plan for a much lower win rate. Measure content performance. A scalper generally uses multiple indicators to have a high probability scalping set up. Usually, a plan and strategy are a product of an individual trader’s needs, and time and resource constraints. A seasoned player may be able to recognize patterns at the open and time orders to make profits. Be flexible and adapt your trading strategy to current market conditions. It has many features, so you will not have any problem using it. Additionally, a tick chart enhances visualization and simplifies the construction of technical analysis chart patterns. That insights gathering instinct must never cease in the quest to learn how to start trading. Contracts for difference CFDs are a way of speculating on the change in value of a foreign exchange rate. Daniel Balakov / Getty Images.

A/C opening Charges

A tick chart in trading represents price changes based on the number of transactions executed. Market volatility can be especially dangerous for trades. While ETRADE only offers these more advanced traders exposure to cryptocurrencies via Spot Bitcoin and Ethereum ETFs and related stocks, traders have access to a wide array of analysis tools, charting functionality, and trading technology to make the most informed decisions in this and many other asset classes. ” As with Merrill Edge, it’s tough to find specific details on SoFi’s margin interest tiers. When the time comes to put in real money, you want to make the best possible decisions when faced with fast paced trade choices, and that comes with understanding and confidence. Connect online and in person. What is the difference between the T+0 and T+1 currency conversion settlement speed options. Alternatively, you might be looking to trade crypto cross pairs. Obviously low fees and currency ownership being the focus. 1% each year, providing site visitors with quality data they can trust. No matter what, the time spent in learning the fundamentals of how to research stocks and experiencing the ups and downs of stock trading — even if there are more of the latter — is time well spent, as long as you’re enjoying the ride and not putting any money you can’t afford to lose on the line. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. Now debating whether it’s worth the risk and looking for alternatives. Speed, quality, transparency. Your trading goals: Are you looking to trade full time and make trading your primary source of income. Trading binary options is made even riskier by fraudulent schemes, many of which originate outside the U. This e mail/ short message service SMS may contain confidential, proprietary or legally privileged information. The ‘Hot Products’ list in our product library highlights stocks that are trading at a higher trade volume than normal. If FI does not consent to delaying the disclosure, the issuer shall disclose the inside information immediately. Rectangles take shape over 1 3 months as the bounds of the range tighten. Many online brokers allow for small minimum deposits which can be a great alternative for those with limited funds. Day trading involves buying and selling financial instruments within the same trading day, ensuring positions are not held overnight. In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases.

Download and install the app

This feature allows for the frequency of transactions. INR 0 on equity delivery. Why Robinhood made the list: Robinhood was a pioneer in the free trading app industry, and it still shines today. Don’t hesitate to tell us about a ticker we should know about, market news or financial education. Sign up and verify your account in under 2 minutes, to trade and invest with unmatched conditions on your desktop or mobile device. The Encyclopedia of Chart Patterns. “The goal of a successful trader is to make the best trades. Let’s find out more about what is meant by a trading account and how to open one. Financial Industry Regulator Authority. Best In Class for Offering of Investments. Chart patterns fall broadly into three categories: continuation patterns, reversal patterns and bilateral patterns. TradeSanta is perfect for those just starting out with automated trading thanks to its user friendly interface. The rule states that if the price starts below the range and stays there for the first hour, there is an 80% chance that it will rise into the area. ETRADE provides educational resources for all levels, including webinars on how to diversify a portfolio and to build an income seeking strategy with ETFs. Gain basic to intermediate Excel skills, review corporate finance and financial accounting concepts, and create comprehensive valuation models in an interactive setting, receiving personalized attention in small group classes. First, it allows traders to demonstrate their ability to generate quick, consistent profits with strict risk management, a key metric for funded trading programs when evaluating a trader’s performance. In this role, you’d help up and coming businesses identify new opportunities, overcome hurdles and unlock growth. In India the American method of settlement is authorised for these options. It requires quick decision making and the ability to analyse market trends and patterns. Take your learning and productivity to the next level with our Premium Templates. Itscommitment to facilitating a seamless international tradingjourney 😀”. She channels her strong passion for fostering tech startup growth through knowledge sharing. For most individuals, long term, diversified investment strategies remain a more reliable path to financial growth. These materials can cover fundamental concepts, technical analysis, and trading strategies, providing valuable guidance to new traders. Hello leishman,Thank you for taking the time to leave us your review. You can lose your money rapidly due to leverage. Thinkorswim gives you a nearly identical experience wherever you log in, including desktop or mobile. Combining this pattern with other indicators enhances its effectiveness in identifying market reversals. Scalp Trading is a kind of day trading that may be thought of as a subset.

How To Build Wealth

8 Businesses That Make Money Right Away In 1 3 Months or Less. As with any style of trading, there are always essential elements that traders might want to keep in mind, and scalping is no different. Relatively large selection of tradable crypto assets. It may be started with a small expenditure and doesn’t need a lot of room. Brokerage will not exceed SEBI prescribed limit. The “best” trading app for beginners can vary based on individual preferences, needs, and the specific financial instruments they’re interested in trading. The term black box refers to an algorithm with obscure and undisclosable internal mechanisms. They can choose to write a simple program that picks out the winners during an upward momentum in the markets. Moreover, traders should pay attention to the following. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. Bottom Line: Its uses cases are rapidly growing and its getting smarter and smarter over time. A commodity trading account is mandatory for investors who wish to trade and earn from the commodity market. It does not represent an actual product or service offered by Elon Musk or any of his companies. The trading account shows the result of buying and selling goods. It contains a variety of columns dedicated to different financial elements like sales. It’s neither overly complicated nor so basic that it’s useless to experienced investors.

Need Help?

Chart patterns work by representing the market’s supply and demand. Trading M patterns offers clear signals for potential trend reversals, well defined entry and exit points, and a generally favorable risk reward ratio, making them an attractive tool for traders looking to identify precise points near the peak of patterns for taking profits or cutting losses. It’s crazy popular, with a huge community you can get involved in, learn from and copy their trades. Indeed, many quants have advanced degrees in fields like applied statistics, computer science, or mathematical modeling. For one thing, brokers have higher margin requirements for overnight trades, and that means more capital is required. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. However, experts caution that sustainable profitability in day trading requires exceptional skill, discipline, and much luck. For example, in the United States, 1GB of internet from companies like Comcast and ATandT costs less than $100 per month. A swing trader aims to make a profit either by buying stocks or short selling them to capitalise on the upward and downward ‘swings’ in the price of a security. Two volume indicators in different modes have been added to the indicator section. Create profiles for personalised advertising. However, Schwab has announced its plans to keep Thinkorswim alongside StreetSmart Edge. By accepting cookies, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Error

Is authorised and regulated by the Cyprus Securities ExchangeCommission CySEC under the license 109/10. Delivery traders are long term investors and may hold on to their investments even for months, years or even decades at times. Beyond its contravention of securities laws, dabba trading also falls within the scope of Sections 406, 420, and 120 B of the IPC, 1870. If the Aroon Up hits 100 and stays relatively close to that level while the Aroon Down stays near zero, that is positive confirmation of an uptrend. More ways to contact Schwab. Since that book is supposedly based on Jesse Livermore anyway, why not just read the real biography. Intraday means “within the day. Therefore, investors need to be cautious while trading on margin and minimize the risk of a debit balance. It’s advisable to stick to stocks of such companies for intraday trades. Conversely, a bearish marubozu pattern, where the candle opens at the high and closes at the low without any wicks, suggests that the sellers have been in control, pushing the price lower. In a nutshell, we’re where the world charts, chats and trades markets. Options trading is also attractive as a hedging tool. Obligation: Futures represent a commitment to trade that must be squared off at the specified date. Neither Classes Near Me “CNM” nor Noble Desktop is affiliated with any schools other than those listed on the Partners Page. In addition to its cost benefits, XTB provides a comprehensive trading platform that caters to both beginners and experienced traders. The overall pattern is formed with a rounding bottom. A ratio of 1 is considered a healthy number, but the number is not absolute and more insights could be gained if you compare it with that of other companies. The blog explains the concept of the Yen carry trade, recent developments leading to its unwinding, and the resulting volatility in global financial markets. Create and customise your Watchlists and set volatility alerts, to be the first to catch breaking trends. Many traders are enticed by the idea of buying and/or deploying an algorithm that can be ignored while it passively generates gains; these traders often lose money.

Products and pricing

Traders should also consider the risk reward ratio of each trade, aiming for setups where the potential profit outweighs the potential loss. How do I choose the right online trading platform for me. This essentially can provide traders with more trading opportunities. Continuation patterns suggest the current trend will continue. Surely, no can deny the therapeutic effects of shopping as a mood lifter on a gloomy day. The trading account format PDF is an effective and powerful tool for identifying areas where cost reduction is possible. Precision in positioning these orders can either fortify the trader’s confidence or leave them susceptible to market volatility. “Increasingly, people are looking at all forms of news and building their own indicators around it in a semi structured way,” as they constantly seek out new trading advantages said Rob Passarella, global director of strategy at Dow Jones Enterprise Media Group. Many brokers have introduced user friendly mobile apps and trading platforms, offering a wealth of information to traders. If you are experiencing difficulties with money, the following pages can help. Carefully selected industry experts contribute their real life experience and expertise to BitDegree’s content. Scalping needs patience and is a highly intense trading method. The answer is that a trading account is necessary since it provides several advantages, such as: disclosing gross profit from which all expenses are deducted to find out the true profit of the business calculating net sales understanding the progress or failure of a business by comparing net sales of the current year with those of the previous year. This is exciting but unrealistic. This reduces the risks of losing all your money on one or a series of bad trades while you’re still learning. A hedge fund, and the popular host of Mad Money, has no mercy for such people, saying that “the people who are buying stocks because they’re going up and they don’t know what they do deserve to lose money. The Stock Exchange, Mumbai is not answerable, responsible or liable for any information on this Website or for any services rendered by our employees, our servants, and us. Infinity IT Park, Bldg. It is also similar to but differs from conventional pumping and dumping, which usually does not involve a relationship of trust and confidence between the fraudster and their victims. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Volume dots in Bookmap show real time traded volume at specific price levels. Avoid any trading software that is a complete black box, and that claims to be a secret money making machine. Charles Schwab’s integration of TD Ameritrade’s educational programs and trading personalities has produced an unparalleled body of actionable learning materials and live training content for beginners. This will help you to work against the odds and beat stock market volatility. FINRA rules require pattern day traders to satisfy the following rules when trading. Past performance is not an indication of future results.

Pricing

The thinkorswim platform is still available to customers even after TD Ameritrade’s takeover by Charles Schwab. Technical analysis looks at the short term picture and can help you to identify short term trading patterns and trends so it’s ordinarily better suited to trading than fundamental analysis, which takes a longer term view. My full time job is engineering on west coast and phone apps are my best bets to trade. Manage Live Positions. It requires time, skill, and discipline. Nevertheless, the effectiveness of central bank “stabilizing speculation” is doubtful because central banks do not go bankrupt if they make large losses as other traders would. For example, investing in equities from economically developed countries is thought to be less risky than those from emerging economies. Integration is completely free for OANDA clients, only standard fees and commission apply. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Zyxeos30 / Getty Images. And our award winning CopyTrader™ technology enables you to replicate top performing traders’ portfolios automatically. For intraday trading, Supertrend is highly effective on a 15 minute chart. This expanded edition consists of 10 new plays and 56 new pages of content describing. Privacy practices may vary based on, for example, the features you use or your age. It applies technical analysis concepts such as over/under bought, support and resistance zones as well as trendline, trading channel to enter the market at key points and take quick profits from small moves. Create profiles for personalised advertising. Mutual funds are an example of an asset that is unavailable for purchase. Value area is the range of price where at least 70% of the previous day’s trade took place. To better understand trade accounts, scroll up to the first topic above. ECN Account Specifications. About 90% of traders report losses during trading.